Emirates Reit Reports 24% Surge in Q1 2025 Property Income and Strong Leasing Performance

Wednesday, 2 July 2025

Emirates Reit posted a 24% year-on-year increase in total property income for Q1 2025, with occupancy reaching 95% and commercial rents up 17%. Strategic refinancing and cost efficiency have further boosted net income, underscoring robust investor and tenant confidence.

Key Highlights:

- Strong Financial Growth:

- Total property income hit $19M in Q1 2025, a 24% YoY increase.

- Net property income steady at $16M, despite asset disposals.

- Operating expenses dropped 8.4% YoY, driven by enhanced efficiency.

- Net finance costs fell 57% due to successful Sukuk refinancing in 2024.

- Robust Portfolio Performance:

- Fair value of investment properties rose 14% YoY to $1.2B (Dh4B).

- Unrealized revaluation gains of $149M supported this growth.

- Occupancy reached 95%, with commercial/retail rents up 17% YoY.

- Dividend and Capital Strategy:

- $7M cash dividend approved for FY2024 ($0.02/share), with potential for more in 2025.

- Two-stage strategy included occupancy boost, cost control, and asset sales.

- Sale proceeds used for debt repayment and capital structure optimization.

- Market Outlook and Demand:

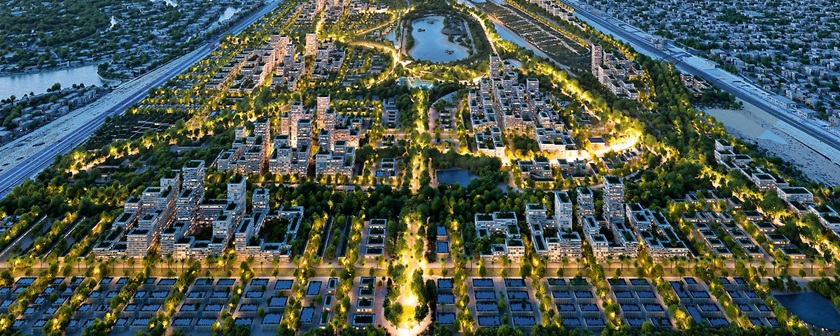

- CEO Thierry Delvaux highlighted UAE’s real estate maturity and investor confidence.

- Office sector under-supplied — pre-leasing likely to rise amid growing demand.

- Commercial and retail space demand fueled by economic momentum and population growth.

- Sustainability and Reit Investment Trends:

- Tenant demand increasingly driven by energy efficiency and build quality.

- Corporate tax exemption may make UAE Reits more attractive to investors.

- Emirates Reit not currently exploring tokenization or fractional ownership, focusing on core growth.